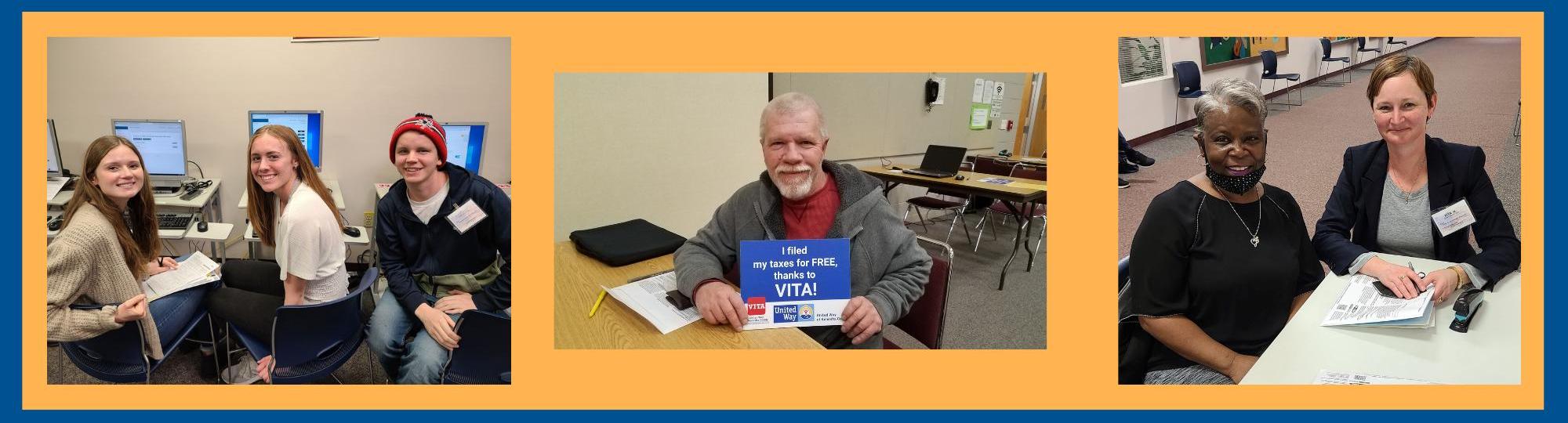

The Volunteer Income Tax Assistance (VITA) program through United Way of Kenosha County provides free tax preparation to individuals and families earning up to $67,000 annually.

Our VITA program helps taxpayers access qualifying tax credits such as Child Tax Credit, Earned Income Tax Credit, the Wisconsin Homestead Credit and more.

Volunteers have helped hard-working Kenosha families walking a financial tightrope receive more than $23 million in qualifying tax credits and refunds!

Welcome to the 2026 tax Season. We look forward to seeing you at our sites!

Keep scrolling for other online self filing options.

Other Free Options For Filing:

myfreetaxes.com

MyFreeTaxes helps people file their taxes for free while getting the assistance they need. United Way provides MyFreeTaxes in partnership with the IRS’s Volunteer Income Tax Assistance (VITA) program to help filers prepare their tax returns on their own or have their return prepared for them for free.

You will create an account and answer a series of questions.

CLICK HERE

MyFreeTaxes is also now available in Spanish at myfreetaxes.com/es.

OR

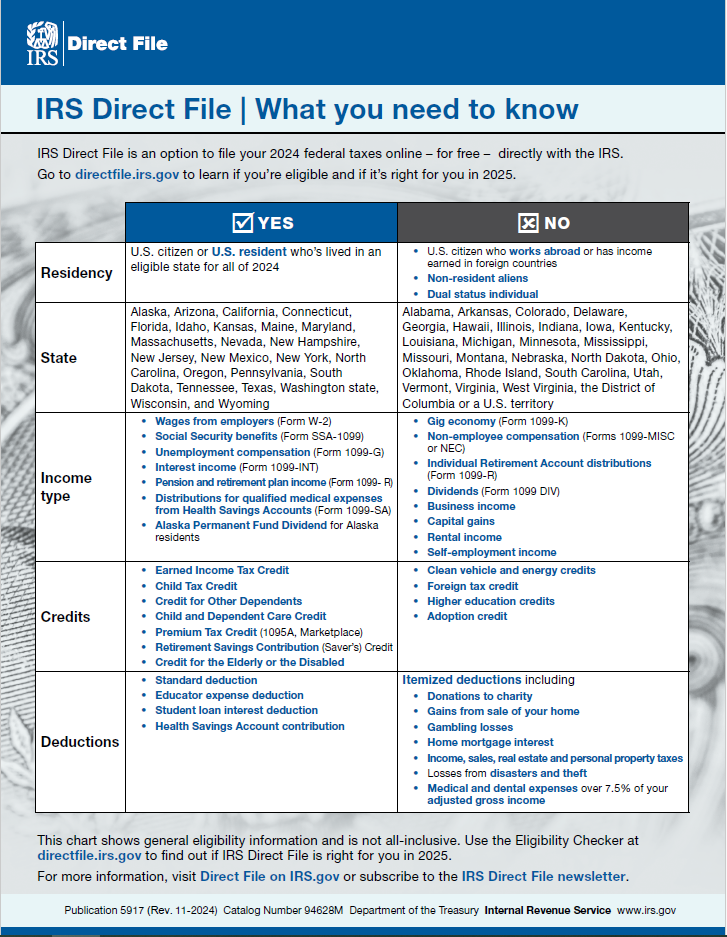

Direct File is a free IRS service that allows people to prepare and file their tax return online. It includes access to help from dedicated IRS Direct File customer support representatives. Direct File is accessible in English and Spanish, and eligible taxpayers can access it and file at directfile.irs.gov using their smartphone, laptop, tablet, or desktop computer.

directfile.irs.gov

If you need assistance with past taxes not done by our VITA team please contact:

https://www.taxpayeradvocate.irs.gov/about-us/low-income-taxpayer-clinics-litc/

If you have any other questions please contact us at info@kenoshaunitedway.org

or call (262) 658-4104

Don't pay to file your taxes. If your household earns less than $73,000 in 2022, you can file your federal and state tax returns for free using MyFreeTaxes.com. This is the only free, national, online tax filing product offered by a nonprofit. United Way has made this available as part of our fight for the financial stability of every person in our community.

MyFreeTaxes is completely free for individuals and families who've earned less than $73,000 in 2022 - whether you file in multiple states, work freelance, have a side gig, or earn investment income. It is powered by H&R Block's premium software, so filing is easy, secure, and guaranteed to be 100% accurate. The software scans for any tax credit your entitled to, making sure you get your maximum refund. If you have questions along the way, IRS-Certified specialists are ready to answer your questions in real time.

Since 2009, over 950,000 Americans have successfully filed using MyFreeTaxes.

►FILE YOUR TAXES ONLINE FOR FREE!

We are still accepting volunteers for next tax season.

Complete the Volunteer Application and the Background Check Form today!

Below you will find additional resources to be used when filing your taxes as well as stories showcasing VITA's impact. Check them out:

Click here to view the "How to Prepare Your Taxes From Home" Instructions

Visit Myfreetaxes.com to file your tax return for free if your household earns under $73,000.

Click here to visit the IRS Non-filer Advanced Child Tax Credit Portal and learn more about who can use it.

Here's how VITA Helps Our Community:

Click here to hear how the VITA program helped Pam.

Click here to learn how VITA helped Cristabel.

Click hear to hear the story of Kim.

For questions and additional assistance, contact unitedway@kenoshaunitedway.org or call 262658-4104

.png)

.png)